|

|

|

|

| |

Select language / Sprache auswählen:

The chain transaction from a German perspective

Update information Chain Transaction Calculator 2026: Whenever the use of a different VAT identification number allows a different assessment, you will find additional chain transaction sketches with the corresponding alternative examples in the evaluations of the Chain Transaction Calculator.

Depending on the chain transaction, there are up to 3 possible solutions!

Following the annual update on 1 January 2026 (including the change in the sales tax rate in Romania), a further update was carried out on 16 January 2026 to incorporate the ECJ ruling T646/24 of 3 December 2025. According to this ruling, triangular transactions can occur not only at the end but also at the beginning of a four-party chain transaction (see example).

General explanatory notes to this page:

The assessment of the chain transactions illustrated here was made from the perspective of the German legislation. I.e. the hypothetical case was assumed that the German law would be applicable in all Member States. Since all Member States implement the EU-directive on the VAT system with their national value added tax laws, the value added tax laws are actually almost the same. There are, however, slight differences which will be not described in detail here.

Term Explanation and Definitions:

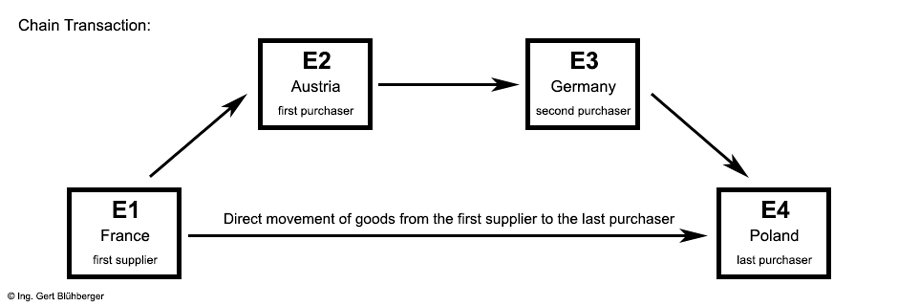

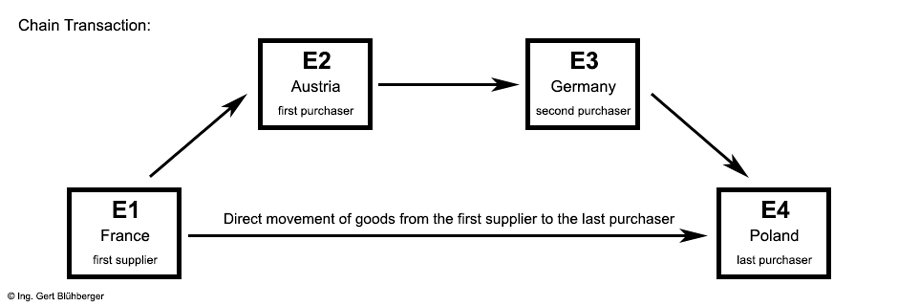

Sales transactions that are carried out by several entrepreneurs on the same item and in the course of which the goods pass directly from the first supplier to the last purchaser during the transport or dispatch (3.14. (4) UStAE (=Value Added Tax Application Decree)), are called chain transactions. Chain transactions are thus characterized by the fact that there is only one single movement of goods for several sales transactions.

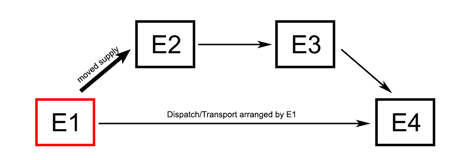

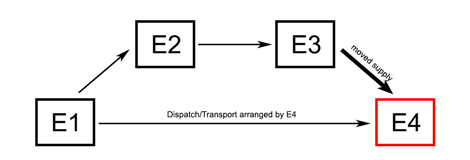

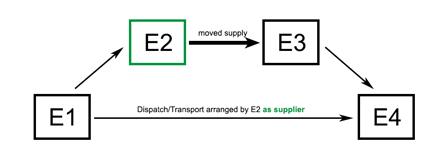

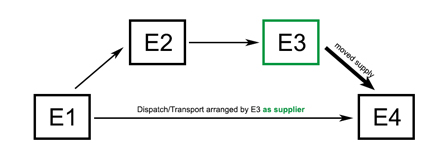

The definitions that can be seen in the below sketch (first supplier, 1st purchaser, 2nd purchaser, last purchaser) apply to all examples. The entrepreneur who arranges the dispatch or transport is framed in red in the sketches. Entrepreneurs who arrange the transport, but act in their capacity as supplier according to § 3 (6a) sentence 4 - 2nd Half-sentence UStG, however, are framed in green.

The terms "supply" and "place of supply" require a special explanation:

The term "supply" is always used in connection with a sales transaction (= invoice) and never in connection with the goods movement (that is, the physical delivery). Similarly, the term "place of supply" is not derived from the actual movement of goods but, in the context of a VAT transaction, indicates the country in which that transaction is taxable and thus subject to value added tax. The fact that the term "supply" in the context of chain transactions has nothing to do with physical delivery may be unusual, but has to do with the definition in § 3 (1) UStG. Here you find the definition that the procurement of the power of disposal is called "supply".

|

Facts (chain transaction):

A Polish entrepreneur E4 (= last purchaser) orders a machine from his German supplier E3 (= 2nd purchaser). The latter in turn orders the machine from the Austrian wholesaler E2 (=1st purchaser). Since the wholesaler E2 does not have the machine in stock, he orders it from the French manufacturer E1 (=first supplier) and instructs him to deliver the machine directly to the Polish entrepreneur E4.

The value added tax with chain transactions:

Since 01.01.2020, § 3 (6a) UStG regulates which of the "supplies" in chain transactions the transport or dispatch is to be assigned to and this results in the consequence, on the one hand, which supplies are taxable in which country (and thus the VAT law of which country is to be applied) and, on the other hand, which of the supplies can enjoy tax exemption if all legal requirements are fulfilled.

Tax exemption with chain transactions:

-

If the goods are transported across one or more national borders, it must be checked which of the sales transactions enjoy tax exemption (due to an export supply according to § 6 UStG or an intra-Community supply according to § 6a UStG).

Ever since the CJEU judgment of the EMAG case (2006), it is clear that dispatch or transport can be ascribed to only one of the successive supplies, which alone could be exempted from VAT (3.14 (2) UStAE).

-

In the event of chain transactions where the goods do not leave the country, the places of supply of all sales transactions are inside the country and thus subject to domestic taxation - there is no tax exemption as a result, and all entrepreneurs involved in the chain transaction must be registered within the country for tax purposes (and thus must have a German VAT identification number) and show the German VAT in their invoice (3.14. (12) UStAE) - even if they are foreign entrepreneurs.

|

| |

Moved Supply / Passive Supply/ Place of Supply:

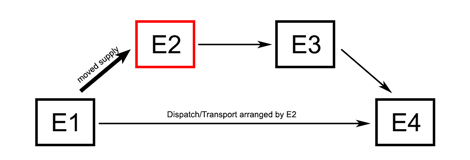

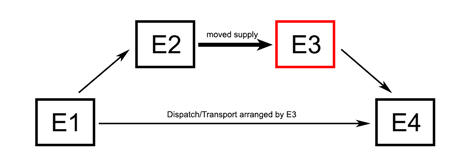

The terms "moved supply" ("Bewegte Lieferung") and "passive supply" ("Ruhende Lieferung") are used only in the German linguistic usage. The physical movement of goods is assigned to the so called "moved supply" and which, as a result thereof, may be tax exempt. All other supplies are described as "passive supplies" and cannot enjoy any tax exemptions. A crucial factor in this assignment is therefore which of the entrepreneurs arranges the dispatch or transport as can be seen in the below sketches (in the first 4 sketches, none of the purchasers makes use of the option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG).

- "Moved supply" (according to § 3 (6) UStG):

Only one of the successive supplies (sales transactions) can enjoy the tax exemption (due to an export supply according to § 6 UStG or an intra-Community supply according to § 6a UStG). This supply is the so-called "moved supply" (literally translated from German).

This "moved supply" is assigned to the supply to the entrepreneur who commissions the transport or dispatch of the goods (For example, if E3 initiates the transport, this is the supply from E2 to E3). Only if the transport or dispatch is initiated by the first supplier, this rule does not work and the supply from the first supplier to the first purchaser is classified as "moved supply".

A transport delivery (3.12. (2) UStAE) obtains when an entrepreneur transports the goods with his own truck. In the case of the dispatch delivery on the other hand (3.12. (3) UStAE), a freight forwarder is commissioned with the transport. It remains, however, irrelevant for the evaluation of which supply is the (exempt) "moved supply" whether the entrepreneur carries out the transport himself or commissions it.

- "Passive supply" (according to § 3 (7) UStG):

In the case of all other sales transactions in the chain (i.e. not in the moved supply), a so-called "passive supply" (literally translated from German) obtains in each case (3.12. (6) UStAE). These supplies are taxable at the place of supply.

- Place of supply:

The place of supply can only ever be either the country of departure or the country of arrival. There are only exceptions in the case of import from a third country (e.g. relocation of the place of supply according to § 3 (8) UStG) and in the case of use of an incorrect VAT identification number, tax liability may arise in the country of the VAT identification number used (double acquisition).

The nationalities of the entrepreneurs in the middle of the chain transaction are thus irrelevant for the determination of the place of supply.

The place of supply also defines the country in which the sales transaction is taxable:

- To be taxed at the place of departure:

a) all passive supplies that are upstream of the moved supply (§ 3 (7)(1) UStG, 3.14. (6) UStAE) and

b) the moved supply itself (§ 3 (6) UStG, 3.14. (5) UStAE).

- To be taxed at the place of arrival:

All passive supplies that are downstream of the moved supply (§ 3 (7)(2) UStG, 3.14. (6) UStAE).

- Exception – relocation of the place of supply according to § 3 (8) UStG:

Notwithstanding the above provisions, a supply from a third country to the domestic market (import) may result in a relocation of the place of supply. According to § 3 (8) UStG, the place of supply is deemed to be within the territory of the country if the supplier or his agent is the debtor for import VAT (see also 3.13. (1) UStAE). The explanation can be found in example 7.

The question of which one of the entrepreneurs acts as supplier and which one as a purchaser is easy to answer for the first and the last entrepreneurs of the chain transaction (3.14. (8) UStAE). However, if one of the intermediate suppliers transports or dispatches the delivery object, he is then the purchaser of the incoming supply from his vendor and also the supplier of the outgoing supply to his customer (3.14. (9) UStAE). In this case, the transport or dispatch is to be generally assigned to the supply of the previous entrepreneur (as in the above sketches).

However, if the entrepreneur in the middle acts in his capacity as supplier (and fulfills the corresponding conditions according to § 3 (6a) sentences 5 to 7 UStG and 3.14. (10) UStAE), the transport or dispatch is attributable to the subsequent supply. The "moved supply" thereby shifts, figuratively speaking, to the right as shown in the below two sketches.

Requirement for exercising the option to choose under § 3 (6a) sentence 4 - 2nd half sentence UStG:

Since 01.01.2020 the provisions of § 3 (6a) sentences 4 to 7 UStG apply, according to which in most cases only the intermediary operator is obliged to give his VAT identification number of the country of departure to his supplier until the beginning of the transport or dispatch and since 25.04.2023 the new provisions of 3.14. (10) UStAE must also be observed:

- § 3 (6a) sentence 4 UStG:

[1st half sentence:] If the object of the supply is transported or dispatched by a purchaser who is also the supplier (intermediary operator), the transport or dispatch is to be assigned to the supply to him,

[2nd half sentence:] unless he proves that he has shipped or dispatched the goods as supplier.

- § 3 (6a) sentence 5 UStG (Intra-Community supply): Where the goods are supplied from the territory of one Member State to the territory of another Member State and the intermediary operator uses a VAT identification number issued to him by the Member State in which the transport or dispatch begins (until the transport or dispatch begins), the transport or dispatch of his supply must be assigned to the intermediary operators supply.

- § 3 (6a) sentence 6 UStG (Export): If the goods are delivered to the third country, sufficient proof pursuant to the fourth sentence shall be assumed if the intermediary operator uses a VAT identification number or tax number issued to him by the Member State in which the transport or dispatch begins, until the transport or dispatch begins.

- § 3 (6a) sentence 7 UStG (Import): If the object of the delivery arrives on Community territory from the territory of a third country, sufficient proof pursuant to the fourth sentence shall be assumed if the object of the delivery is declared for free circulation on behalf of the intermediary operator or within the frame of indirect representation.

- Art. 36a (3) VAT Directive 2006/112 (Definition intermediary operator): For the purposes of this Article, "intermediary operator" means a supplier within the chain other than the first supplier in the chain who dispatches or transports the goods either himself or through a third party acting on his behalf.

- 3.14. (10) UStAE (excerpt from 3.14. (10) UStAE) - valid since 25.04.2023:

..... The term "use" of a VAT identification number presupposes a positive action by the middle entrepreneur. Since this is the realisation of the facts (acting as a supplier), subsequent changes in the use of the VAT identification number have no effect. If the middle entrepreneur uses the VAT identification number issued to him by the country of departure, this must usually be done when the contract is concluded or at the latest when the delivery is made. The VAT identification number used should be recorded in writing in the respective contract document. .... A VAT identification number merely printed on a form in a document is not sufficient. ....

Note: For the period up to 25 April 2023, according to the BMF letter, it is not objectionable if the allocation of transport responsibility has been determined by the parties involved by mutual agreement in deviation from section 3.14 (7) to (11) UStAE.

Until 31.12.2019 most member states did not have such a right to choose and German entrepreneurs were often forced to choose according to 3.14. (19) UStAE, the ascription of dispatch/transport on the basis of the right of another Member State participating in the chain transaction.

Since 01.01.2020, there has been greater legal certainty in these cases, at least in the case of intra-Community chain transactions, because here the Art. 36a VAT Directive 2006/112 applies throughout Europe. However, the VAT Directive has no effect on chain transactions involving import or export. Here, as before, the respective national law must be taken into account.

In the following examples, the colored frame of the entrepreneur arranging the transport indicates whether the option described above is exercised. If the frame is green, the option is exercised and if the frame is red, this is the standard case according to § 3 (6a) sentence 4 - 1. half sentence UStG. |

|

Chain transaction example 1: The German entrepreneur is the first supplier (E1).

All 4 entrepreneurs are located within the Community territory.

Also, visit the chain transaction calculator. With just a few clicks, you can evaluate your particular chain transaction here. By clicking on the above sketch, you get directly to the chain transaction Germany/Austria/France/Poland of the chain transaction calculator.

Facts (from the perspective of the German entrepreneur E1):

The German entrepreneur E1 (= first supplier) charges the ordered goods to the Austrian entrepreneur E2 (= 1st purchaser). But the goods pass directly to the Polish purchaser E4 (= last purchaser).

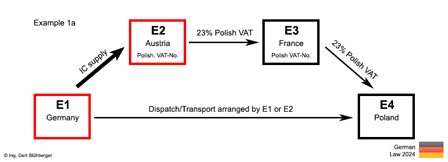

- Example 1a (dispatch/transport arranged by E1 or E2):

The intra-Community supply is assigned to the sales transaction between E1 (Germany) and E2 (Austria) and can enjoy the tax exemption. The German entrepreneur E1 therefore issues an invoice without VAT to the Austrian entrepreneur E2. The invoice must contain the note "intra-Community supply pursuant to § 4 (1)(b) UStG in conjunction with § 6a UStG" as well as the Polish VAT identification number of the Austrian entrepreneur E2. E2 must therefore be registered in Poland (cf. 3.14. (13) example 1a UStAE and 3.14. (13) example 2 UStAE).

We therefore recognize right away in the first example that the individual entrepreneurs involved in a chain transaction are in most cases forced to register in another Member State for VAT purposes. This means for the Austrian entrepreneur E2 in this example that he has to obtain a VAT registration in the country of arrival (Poland) and must file VAT returns. Depending on the type of transactions in which the Austrian entrepreneur E2 engages, a payment burden, a credit, or, in exceptional cases, a zero-sum game may take place.

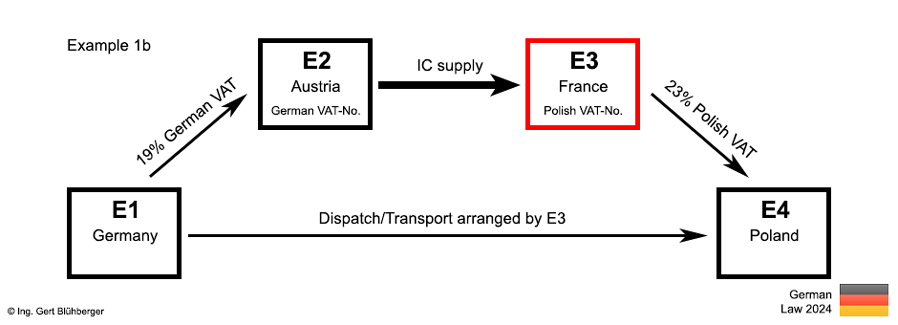

- Example 1b (dispatch/transport arranged by E3):

The sales transaction between E1 (Germany) and E2 (Austria) is not tax-exempt. The German entrepreneur E1 thus issues an invoice with German VAT to the Austrian entrepreneur E2.

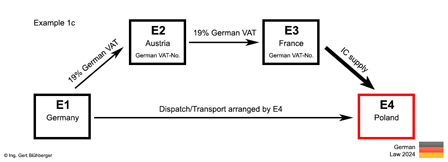

- Example 1c (Transport arranged by E4):

The sales transaction between E1 and E2 is not tax-exempt. Like in example 1b, the German entrepreneur E1 thus issues an invoice with a German VAT to the Austrian entrepreneur E2.

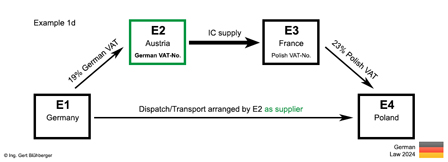

- Example 1d (Transport arranged by E2 as supplier):

In this example, E2 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E1 of his German VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 1b.

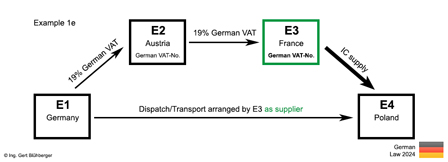

- Example 1e (Transport arranged by E3 as supplier):

In this example, E3 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E2 of his German VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 1c.

With regard to examples 1b and 1d, it should be noted that the simplification rules for triangular transactions could be applied if the entrepreneur E3 is not established in the country of destination (Poland). For more information on triangular transactions within 4-tiered chain transactions, please see www.triangular-transaction.de.

|

|

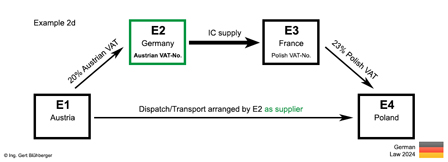

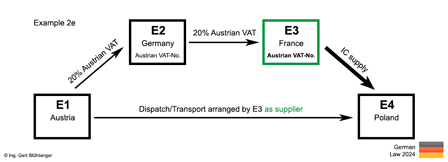

Chain transaction-example 2:

The German entrepreneur is the 1st purchaser (E2).

All 4 entrepreneurs are located within the Community territory.

Also, visit the chain transaction calculator. By clicking on one of the above sketches, you get to the appropriate example of the chain transaction calculator (www.chaintransaction-calculator.de). The example can also be evaluated for other countries here.

Facts (from the perspective of the German entrepreneur E2):

The Austrian entrepreneur E1 (=1st supplier) charges the goods to the German entrepreneur E2 (=1st purchaser). The German entrepreneur then charges the goods to the French entrepreneur E3 (=2nd purchaser). But the goods go directly from the Austrian entrepreneur E1 to the Polish entrepreneur E4 (= last purchaser).

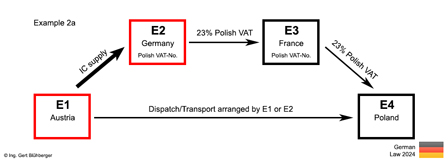

- Example 2a (dispatch/transport arranged by E1 or E2):

The intra-Community supply is assigned to the sales transaction between E1 (Austria) and E2 (Germany) and can enjoy the tax exemption. The German entrepreneur E2 therefore receives an incoming invoice without VAT on the basis of an intra-Community supply.

The sales transaction between E2 (Germany) and E3 (France) is not tax-exempt. All sales transactions that follow the intra-Community acquisition are taxable in the country of arrival (Poland). The German entrepreneur E2 issues an invoice with Polish VAT and stating the Polish VAT identification number to the French entrepreneur E3.

The German entrepreneur E2 has therefore to obtain a VAT registration in Poland first and hence receives a Polish VAT identification number. With this Polish VAT identification number, he not only acts towards the French entrepreneur E3, but also towards his Austrian supplier E1. He must pay VAT (acquisition tax) in Poland for the intra-Community acquisition of the supply from Austria, but is also entitled to reclaim this tax due as input VAT (=zero-sum game). He must, however, pay the Polish VAT charged to the French entrepreneur E3 to the Polish tax office. (cf. 3.14. (13) example 1a UStAE and 3.14. (13) example 2 UStAE).

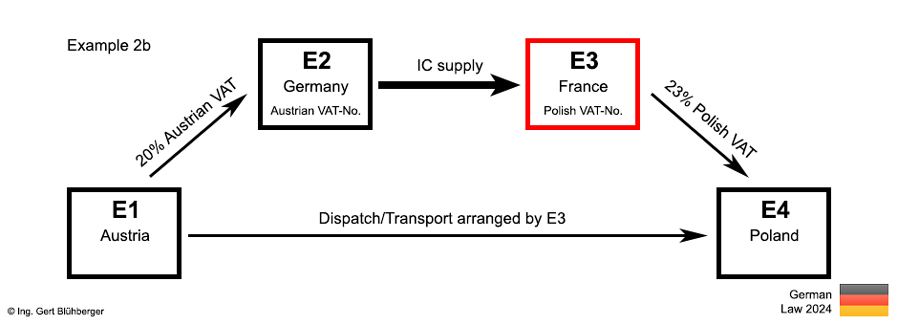

- Example 2b (Transport arranged by E3):

The sales transaction between E1 (Austria) and E2 (Germany) is not tax-exempt. All sales transactions upstream of the intra-Community supply are taxable in the country of departure (Austria). Therefore, the German entrepreneur E2 receives an incoming invoice with Austrian VAT and has to obtain a VAT registration in Austria first. He thereby has the ability to deduct the input tax from this sales transaction at the Austrian tax office.

The intra-Community supply is assigned to the sales transaction between E2 (Germany) and E3 (France) and can enjoy the tax exemption. The German entrepreneur E2 therefore issues an invoice without VAT to the French entrepreneur E3. The invoice must contain the note "intra-Community supply pursuant to § 4 (1)(b) UStG in conjunction with § 6a UStG" (or the corresponding paragraphs of the Austrian Value Added Tax Act) as well as the Austrian VAT identification number of the German entrepreneur E2 and the Polish VAT identification number of the French entrepreneur E3.

The intra-Community supply and the subsequent intra-Community acquisition therefore do not take place between the countries involved in this sales transaction (Germany and France), but between the country of departure (Austria) and the destination country Poland (cf. 3.14. (13) example 3 UStAE)!

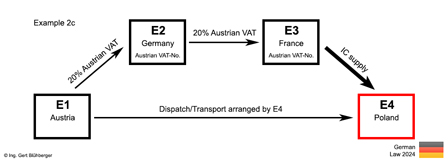

- Example 2c (Transport arranged by E4):

The intra-Community supply is assigned to the sales transaction between E3 (France) and E4 (Poland) and can enjoy the tax exemption. All sales transactions upstream of the intra-Community supply are taxable at the place of departure (Austria). This applies to both the sales transaction between E1 (Austria) and E2 (Germany) as well as the subsequent sales transaction with E3 (France). From the perspective of the German entrepreneur E2, both his incoming invoice as well as his outgoing invoice are therefore subject to the Austrian VAT. He has therefore to obtain a VAT registration in Austria and operate with his Austrian VAT identification number in both directions. He can, however, offset the input VAT against the output VAT. In the event that the outgoing invoice doesn't include any markup, this would be a zero-sum game (cf. 3.14. (13) example 4 UStAE).

- Example 2d (Transport arranged by E2 as supplier):

In this example, E2 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E1 of his Austrian VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 2b.

- Example 2e (Transport arranged by E3 as supplier):

In this example, E3 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E2 of his Austrian VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 2c.

With regard to examples 2b and 2d, it should be noted that the simplification rules for triangular transactions could be applied if the entrepreneur E3 is not established in the country of destination (Poland). For more information on triangular transactions within 4-tiered chain transactions, please see www.triangular-transaction.de.

|

|

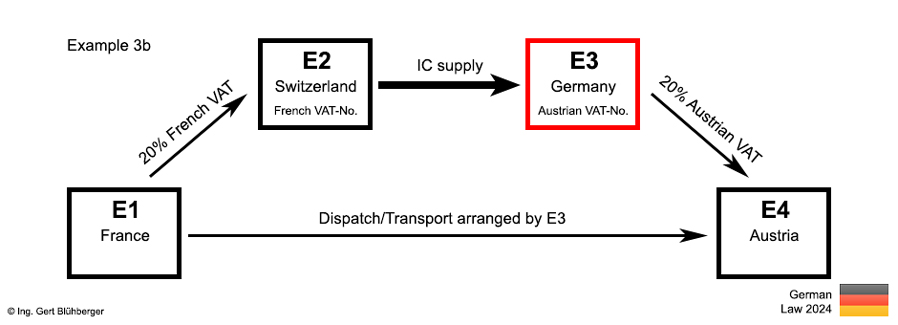

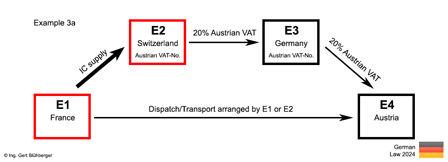

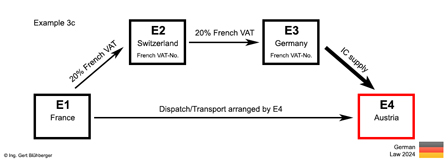

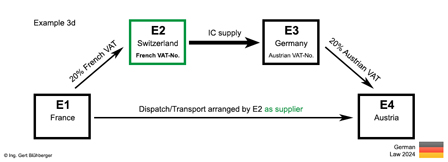

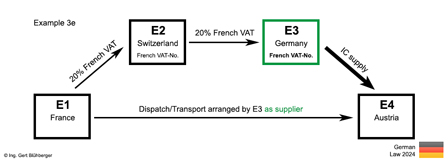

Chain Transaction Example 3: Chain transaction with third country reference.

The German entrepreneur is the 2nd purchaser (E3).

Also, visit the chain transaction calculator. By clicking on one of the above sketches, you get to the appropriate example of the chain transaction calculator (www.chaintransaction-calculator.de). The example can also be evaluated for other countries here.

Facts (from the perspective of the German entrepreneur E3):

The Swiss entrepreneur E2 (=1st purchaser) charges the goods to the German entrepreneur E3 (=2nd purchaser). The German entrepreneur then charges the goods to the Austrian entrepreneur E4 (=last purchaser). But the goods pass directly from the French entrepreneur E1 to the Austrian entrepreneur E4.

Note to this example:

In this example, an entrepreneur from a third country is now involved for the first time. As you will see below, this third country reference has no special impact at all because the goods do not leave the Community territory. The Swiss entrepreneur E2 must integrate himself in the chain transaction just like everyone else by registering in the respective country.

- Example 3a (dispatch/transport arranged by E1 or E2):

The sales transactions between E2 (Switzerland) and E3 (Germany) as well as to E4 (Austria) are not tax-exempt. All sales transactions following the intra-Community acquisition are taxable in the country of arrival (Austria). From the perspective of the German entrepreneur E3, both his incoming invoice as well as his outgoing invoice are subject to the Austrian VAT. He has therefore to obtain a VAT registration in Austria and operate with his Austrian VAT identification number in both directions. He can, however, offset the input VAT against the output VAT.

- Example 3b (dispatch/transport arranged by E3):

The intra-Community supply is assigned to the sales transaction between E2 (Switzerland) and E3 (Germany) and can enjoy the tax exemption. The German entrepreneur E3 therefore receives an incoming invoice without VAT on the basis of an intra-Community supply.

The sales transaction between E3 (Germany) and E4 (Austria) is not tax-exempt. All sales transactions following the intra-Community acquisition are taxable in the country of arrival (Austria). The German entrepreneur E3 therefore subsequently issues an invoice with Austrian VAT to the Austrian entrepreneur E4, stating his Austrian VAT identification number.

The German entrepreneur E3 has to obtain a VAT registration in Austria first, thereby obtaining an Austrian VAT identification number. He not only acts towards the Austrian entrepreneur E4, but also towards his Swiss supplier E2 with this Austrian VAT identification number. He must therefore also pay VAT (acquisition tax) in Austria for the intra-Community acquisition of the supply from the Swiss entrepreneur E2, but is also entitled to reclaim this tax due as input VAT (=zero-sum game). He must however pay the Austrian VAT charged to the Austrian entrepreneur to the Austrian Tax Office. (Unless the

Austrian entrepreneur E4 keeps the VAT from this sales transaction on the basis of the liability provisions of the Austrian Value Added Tax Act and pays it to the Austrian Tax Office in the name of the German entrepreneur E3. For detailed information on this liability provision according to § 27 (4) öUStG (Austrian Value Added Tax Act), see www.reihengeschaeft.at.

In practice, 4 sources of error exist right away when issuing or posting the invoices:

- The incoming invoice of the Swiss entrepreneur must not be posted as "import 0%" as usual, but must be posted as "intra-Community acquisition".

- The "intra-Community acquisition" must not get posted with the tax key that corresponds to the German VAT return evaluation as usual, but must get posted with a tax key that corresponds to the Austrian VAT return evaluation. The VAT may therefore not be calculated with 19 % but with the Austrian tax rate of 20 % instead.

- The outgoing invoice to the Austrian entrepreneur E4 must not be made out as an intra-Community supply without VAT as usual but must be made out as domestic supply with the 20 % Austrian VAT included.

- The outgoing invoice must not get posted with the tax key that corresponds to the German VAT return evaluation as usual, but must get posted with a tax key (20 %) that corresponds to the Austrian VAT return evaluation.

- Example 3c (dispatch/transport arranged by E4):

The sales transaction between E2 (Switzerland) and E3 (Germany) is not tax-exempt. All sales transactions upstream of the intra-Community supply are taxable at the place of departure (France). The German entrepreneur E3 therefore receives an incoming invoice with French VAT and has to obtain a VAT registration in France first. He thereby has the ability to deduct the VAT from this sales transaction with the French tax authorities.

The intra-Community supply is assigned to the sales transaction between E3 (Germany) and E4 (Austria) and can enjoy the tax exemption. The German entrepreneur E3 therefore issues an invoice without VAT to the Austrian entrepreneur E4. The invoice must contain the note "intra-Community supply pursuant to § 4 (1)(b) UStG in conjunction with § 6a UStG" (or the corresponding paragraphs of the French Value Added Tax Act) as well as the French VAT identification number of the German entrepreneur E3 and the Austrian VAT identification number of the Austrian entrepreneur E4 (cf. 3.14. (13) example 4 UStAE).

The intra-Community supply and the intra-Community acquisition following it therefore do not take place between the countries involved in this sales transaction (Germany and Austria), but between the country of departure (France) and the country of arrival (Austria)!

- Example 3d (Transport arranged by E2 as supplier):

In this example, E2 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E1 of his French VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 3b.

- Example 3e (Transport arranged by E3 as supplier):

In this example, E3 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E2 of his French VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 3c.

With regard to examples 3b and 3d, it should be noted that the simplification rules for triangular transactions could be applied if the entrepreneur E3 is not established in the country of destination (Austria). For more information on triangular transactions within 4-tiered chain transactions, please see www.triangular-transaction.de.

|

|

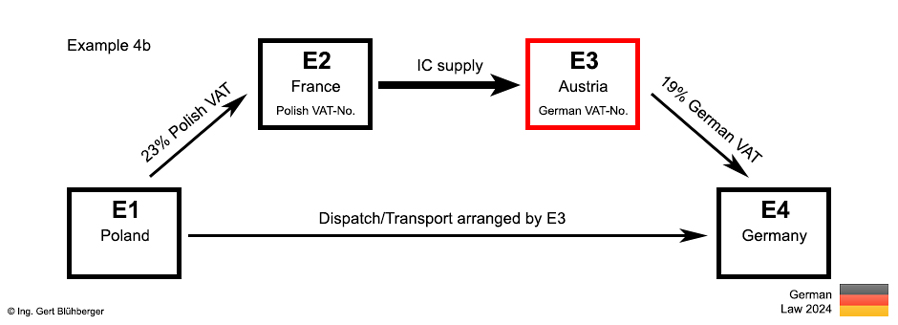

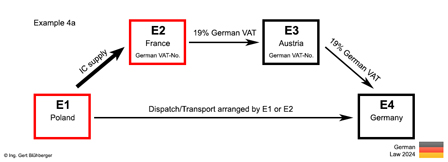

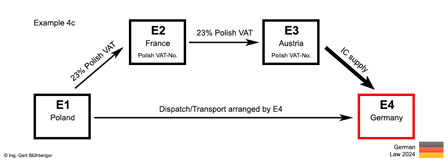

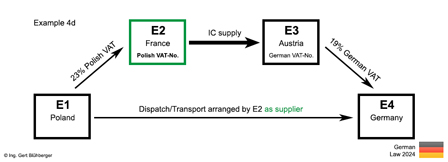

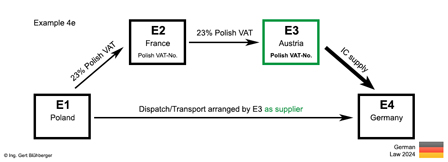

Chain Transaction-Example 4: The German entrepreneur is the last purchaser (E4).

All 4 entrepreneurs are located within the Community territory.

Also, visit the chain transaction calculator. By clicking on one of the above sketches, you get to the appropriate example of the chain transaction calculator (www.chaintransaction-calculator.de). The example can also be evaluated for other countries here.

Facts (from the perspective of the German entrepreneur E4):

The Austrian entrepreneur E3 (=2nd purchaser) charges the goods to the German entrepreneur E4 (=last purchaser). But the goods pass directly from the Polish entrepreneur E1 (=1st supplier) to the German entrepreneur E4.

- Example 4a (dispatch/transport arranged by E1 or E2):

The sales transaction between E3 (Austria) and E4 (Germany) is not tax-exempt. All sales transactions following the intra-Community acquisition are taxable in the country of arrival (Germany). The sales transaction between E3 (Austria) and E4 (Germany) is therefore subject to German VAT. The Austrian entrepreneur E3 has to obtain a VAT registration in Germany and make out the invoice with German VAT.

- Example 4b (dispatch/transport arranged by E3):

The sales transaction between E3 (Austria) and E4 (Germany) is subject to the German VAT like in example 4a. The Austrian entrepreneur E3 has to obtain a VAT registration in Germany.

- Example 4c (dispatch/transport arranged by E4):

The intra-Community supply is assigned to the sales transaction between E3 (Austria) and E4 (Germany) and can enjoy the tax exemption. The German entrepreneur E4 therefore receives an incoming invoice without VAT on the basis of an intra-Community supply.

All sales transactions upstream of the intra-Community supply are taxable at the place of departure (Poland). The Austrian entrepreneur E3 thus acts with his Polish VAT identification number towards the German entrepreneur E4. The intra-Community supply from E3 to E4 is also taxable in the country of departure (even though tax-exempt).

- Example 4d (Transport arranged by E2 as supplier):

In this example, E2 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E1 of his Polish VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 4b.

- Example 4e (Transport arranged by E3 as supplier):

In this example, E3 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E2 of his Polish VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 4c.

With regard to examples 4b and 4d, it should be noted that the simplification rules for triangular transactions could be applied if the entrepreneur E3 is not established in the country of destination (Germany). For more information on triangular transactions within 4-tiered chain transactions, please see www.triangular-transaction.de.

|

|

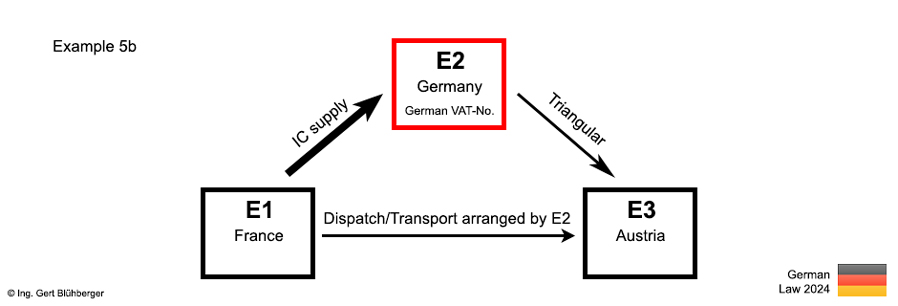

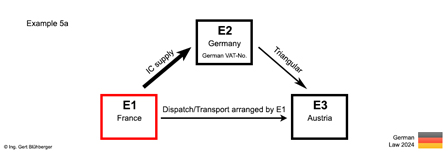

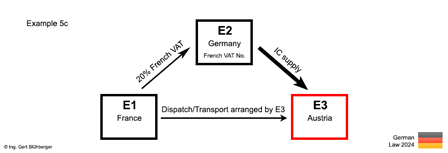

Chain transaction/triangular transaction example 5: All 3 entrepreneurs are located within the Community territory.

In 2 of the 3 cases a triangular transaction obtains.

Also, visit the chain transaction calculator. By clicking on one of the above sketches, you get to the appropriate example of the chain transaction calculator (www.chaintransaction-calculator.de). The example can also be evaluated for other countries here.

Facts (from the perspective of the German entrepreneur E2):

The French entrepreneur E1 charges the goods to the German entrepreneur E2. The German entrepreneur then charges the goods to the Austrian entrepreneur E3. But the goods pass directly from the French entrepreneur E1 to the Austrian entrepreneur E3.

- Example 5a (dispatch/transport arranged by E1):

In this example, the special case of a chain transaction is realized - namely a triangular transaction. In the case of a triangular transaction, the simplification rule of § 25b UStG can be applied. This simplification rule causes the tax liability of the first purchaser E2 (Germany) transfers to the last purchaser E3 (Austria) (25b.1. (7) UStAE).

None of the entrepreneurs involved in the triangular transaction have to obtain a foreign VAT registration.

For the exact conditions for a triangular transaction as well as detailed information on the sequence of a triangular transaction, see www.triangular-transaction.de.

- Example 5b (dispatch/transport arranged by E2):

Just like example 5a, this example is a triangular transaction with the same legal consequences.

- Example 5c (dispatch/transport arranged by E3):

By way of exception, this example is not a triangular transaction since the dispatch/transport is arranged by the last purchaser E3. The value added tax provisions thus need to be applied just like with all other chain transactions (25b1. (5) Example b UStAE):

The sales transaction between E1 (France) and E2 (Germany) is not tax-exempt. This sales transaction is taxable at the place of departure (France). The German entrepreneur E2 therefore receives an incoming invoice with French VAT and has to obtain a VAT registration in France first. He thereby has the ability to deduct the VAT from this sales transaction with the French tax authorities.

The sales transaction between E2 (Germany) and E3 (Austria) is tax-exempt. The German entrepreneur E2 therefore issues an invoice without VAT to the Austrian entrepreneur E3. The invoice must contain the note "intra-Community supply pursuant to § 4 (1)(b) UStG in conjunction with § 6a UStG" (or the corresponding paragraphs of the French Value Added Tax Act) as well as the French VAT identification number of the German entrepreneur E2 and the Austrian VAT identification number of the Austrian entrepreneur E3.

|

|

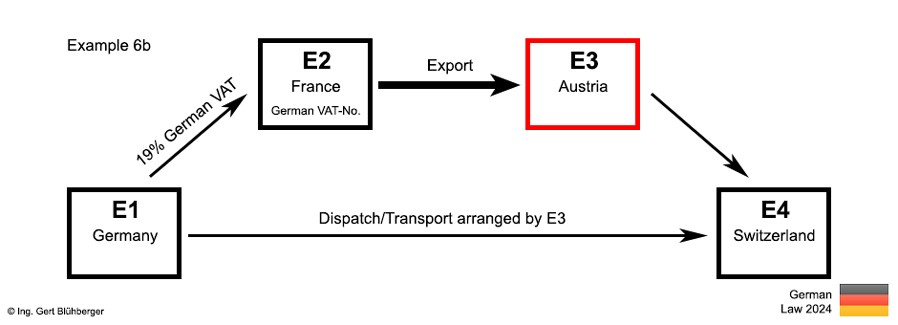

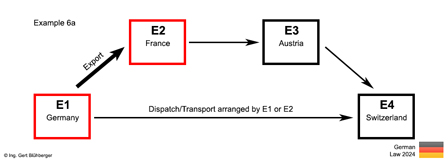

Chain transaction-example 6:

Chain transaction with third country reference / Export (3.14. (14) UStAE).

Facts (from the perspective of the German entrepreneur E1):

The German entrepreneur E1 sells the goods to the French entrepreneur E2. But the goods go directly from the German entrepreneur E1 to the Swiss entrepreneur E4.

- Example 6a (dispatch/transport arranged by E1 or E2):

The export supply is assigned to the sales transaction between E1 (Germany) and E2 (France) and can enjoy the tax exemption. The German entrepreneur E1 therefore issues an invoice without VAT to the French entrepreneur E2. The invoice must contain the note "Export supply pursuant to § 4 (1)(a) UStG in conjunction with § 6 UStG".

All sales transactions that follow the export supply are taxable in the country of arrival (Switzerland). Whether or not the sales transactions between E2, E3 and E4 are subject to a VAT is governed by the legal provisions of the third country and is not analyzed in more detail here, since Switzerland is only a symbolic example of many possible third countries.

- Example 6B (dispatch/transport arranged by E3):

The sales transaction between E1 (Germany) and E2 (France) is not tax-exempt. All sales transactions upstream of the export supply are taxable at the place of departure (Germany). The German entrepreneur E1 therefore issues an invoice with German VAT to the French entrepreneur E2.

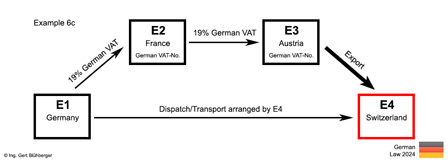

- Example 6c (Transport arranged by E4):

The sales transaction between E1 and E2 is not tax-exempt. The German entrepreneur E1 therefore issues an invoice with German VAT to the French entrepreneur E2, like in the previous example.

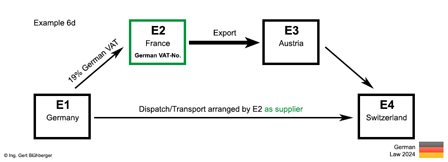

- Example 6d (Transport arranged by E2 as supplier):

In this example, E2 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E1 of his German VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 6b.

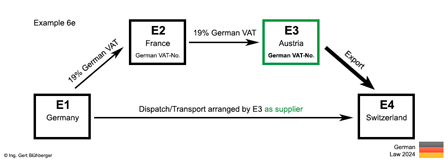

- Example 6e (Transport arranged by E3 as supplier):

In this example, E3 makes use of his option to choose according to § 3 (6a) sentence 4 - 2nd half sentence UStG by informing E2 of his German VAT identification number before the beginning of the transport or dispatch. The legal consequence of this variant corresponds to example 6c.

|

|

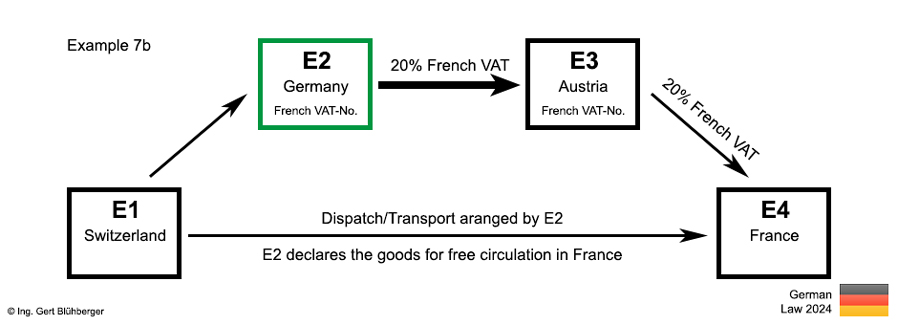

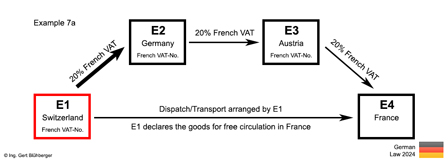

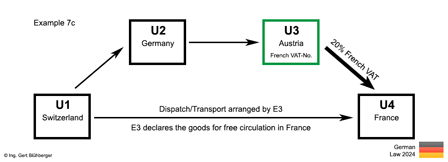

Chain transaction-example 7:

Chain transaction with third country reference / Import with relocation of the place of supply:

Facts (from the perspective of the German entrepreneur E2):

The Swiss entrepreneur E1 charges the goods to the German entrepreneur E2. The German entrepreneur then charges the goods to the Austrian entrepreneur E3. But the goods pass directly from the Swiss entrepreneur E1 to the French recipient E4. The declaration for free circulation is always made for the transport initiating entrepreneur.

- Relocation of the place of supply:

Pursuant to § 3 (8) UStG, if the supplier or his representative is liable to pay the import VAT, the place of supply is shifted from the third country (Switzerland) to that country in which the goods are declared for free circulation (France).

Example 7a: Here, the relocation of the place of supply takes place because the first supplier is liable to pay the import VAT.

Examples 7b and 7c: In these examples the intermediary operators E2 or E3 are liable to pay the import VAT, but since they fulfil the conditions of § 3 (6a) sentence 7 UStG (...sufficient proof pursuant to the fourth sentence shall be assumed if the object of the delivery is declared for free circulation on behalf of the intermediary operator...), they act as suppliers. Since the intermediary operator act as supplier, 2 consequences are triggered:

- The dispatch/transport is assigned to supply of the intermediary operator

- A relocation of the place of supply according to § 3 (8) UStG takes place

Therefore, in all 3 examples a relocation of the place of supply takes place.

- Example 7a (dispatch/transport arranged by E1):

Although the dispatch/transport is assigned to the supply between E1 (Switzerland) and E2 (Germany), it cannot enjoy tax exemption due to the relocation of the place of supply in accordance with § 3 (8) UStG. The German entrepreneur E2 therefore receives an incoming invoice with French VAT from the Swiss entrepreneur E1. Since the Swiss entrepreneur E1 arranges the dispatch of the goods, he has the right to dispose of the goods during the dispatch (15.8. (6) UStAE) and is liable to pay the import VAT. He is therefore entitled to reclaim this VAT paid on the imported goods as input VAT (15.8. (1) UStAE).

All sales transactions that follow the moved supply are taxable in the country of arrival (France). The German entrepreneur E2 thus issues an invoice with French VAT to the Austrian entrepreneur E3. Therefore, both the German entrepreneur E2 and the Austrian entrepreneur E3 as well as the Swiss entrepreneur E1 must be registered in France and act with their French VAT identification number.

- Example 7b (dispatch/transport arranged by E2):

The sales transaction between E1 (Switzerland) and E2 (Germany) is not tax-exempt. This sales transaction is taxable at the place of departure (Switzerland). Whether or not this sales transaction is subject to a VAT is governed by the legal provisions of the third country and is not analyzed in more detail here, since Switzerland is only a symbolic example of many possible third countries.

Although the dispatch/transport is assigned to the supply between E2 (Germany) and E3 (Austria), it cannot enjoy tax exemption due to the relocation of the place of supply in accordance with § 3 (8) UStG. This delivery is taxable in the country of importation (France) and the German entrepreneur E2 therefore issues an invoice with French VAT to the Austrian entrepreneur E3. All sales transactions that follow the moved supply are taxable in the country of arrival (France). Therefore, both the German entrepreneur E2 and the Austrian entrepreneur E3 must be registered in France and act with their French VAT identification number.

- Example 7c (dispatch/transport arranged by E3):

Both the sales transaction between E1 (Switzerland) and E2 (Germany) and the sales transaction between E2 (Germany) and E3 (Austria) are not tax-exempt. Both sales transactions are upstream of the moved supply and therefore taxable in the country of departure (Switzerland). Whether or not these sales transactions are subject to a VAT is governed by the legal provisions of the third country and is not analyzed in more detail here, since Switzerland is only a symbolic example of many possible third countries.

- Example 7d - without sketch (dispatch/transport arranged by E4):

If the entrepreneur U4 initiates the transport, the standard assignment rules for dispatch/transport are again applied. The dispatch/transport is assigned to the supply between E3 and E4 and enjoys the tax exemption due to the import from Switzerland.

|

|

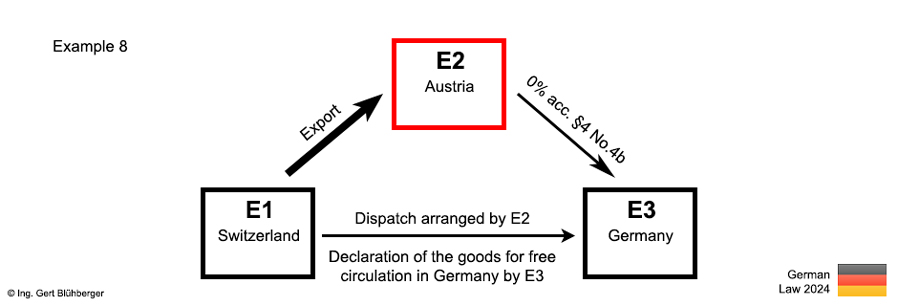

Chain transaction example 8:

Import without relocation of the place of supply / Tax exemption pursuant to § 4 No. 4b UStG:

Facts:

A German entrepreneur E3 orders a machine from his Austrian supplier E2. Since the supplier E2 does not have the machine in stock, he orders it from the Swiss wholesaler E1. The Austrian supplier E2 arranges the dispatch from the wholesaler E1 directly to the entrepreneur E3 in Germany. The declaration of the goods for free circulation in Germany is made for the German entrepreneur E3.

- Export supply (E1 to E2):

Since in this example the declaration for free circulation is not made for the intermediary operator E2 but for the entrepreneur E3, the conditions of § 3 (6a) sentence 7 UStG are not fulfilled and consequently there is neither a "postponement of the moving supply" nor a "relocation of the place of supply". The sales transaction between E1 (Switzerland) and E2 (Austria) can therefore enjoy the tax exemption because the export supply is assigned to this transaction. The Austrian entrepreneur E2 therefore receives an incoming invoice without VAT from the Swiss entrepreneur E1 on the basis of the import supply from Switzerland.

- Subsequent supply (E2 to E3):

All sales transactions that follow the export supply are taxable in the country of arrival (Germany). The Austrian entrepreneur E2 would therefore have to register in Germany for VAT purposes and make out an invoice with German VAT to the German entrepreneur E3 (unless he takes advantage of the tax exemption provision of § 4 No. 4b UStG described below).

- Tax exemption pursuant to. § 4 No. 4b UStG:

The tax exemption provision of § 4 No. 4b UStG states that the supplies of goods preceding an import are exempt from tax if the purchaser or his representative imports the goods supplied.

Consequently, in the above example the supply from E2 to E3 would be tax-exempt. According to the wording of § 4 No. 4b UStG, this tax-exemption could be applied both when the goods are imported from a bonded warehouse and when the declaration for free circulation has already been made at the time of crossing the border. Accordingly, this tax exemption scheme is also in 3.14. (16) Example 1 UStAE applied and there is no reference to a customs warehouse here either. It is merely stated here that the declaration for free circulation is made by the 3rd entrepreneur after the 2nd entrepreneur has handed over the goods to him.

Unfortunately, 4.4b.1 UStAE contradicts this. Here, an unambiguous restriction must be found, according to which the tax-exemption of § 4 No. 4b UStG only applies to supplies of non-Union goods which are placed under a special customs procedure pursuant to Article 210 UZK. The BMF letter of 28.01.2004 mentioned in 4.4b.1 UStAE also refers exclusively to supplies within a bonded warehouse.

Unfortunately, I do not know what the BMF's position is on the contradiction mentioned above. In the historical search for legislation, I have noticed that the example 3.14. (16) UStAE was already included in the UStR 2000 and already then the 2nd supply in this example was so to speak tax-exempt (according to § 50 UStDV, the collection of the tax due was waived). Although I would be very surprised if the simplifications planned by the StÄndG 2003 had led to a tightening, a certain legal uncertainty must be feared in the case of declarations for free circulation at the time of crossing the border.

|

|

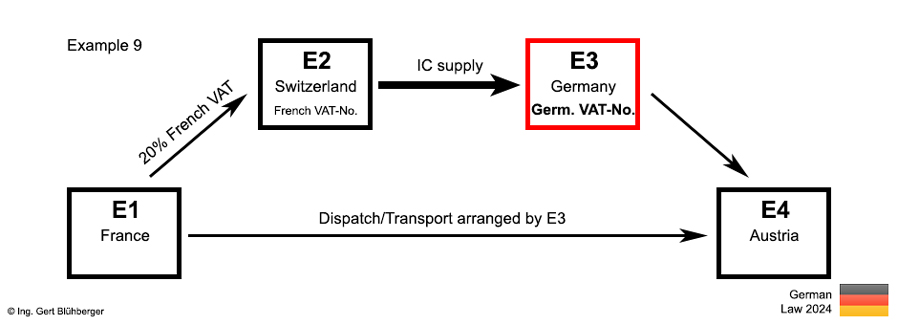

Chain transaction example 9:

Double acquisition:

Facts (from the perspective of the German entrepreneur E3):

The Swiss entrepreneur E2 charges the goods to the German entrepreneur E3. The German entrepreneur then charges the goods to the Austrian entrepreneur E4. The German entrepreneur E3 transports the goods from France to Austria. The German entrepreneur E3 is also resident in Austria and the application of the simplification rules for triangular transactions are thus not allowed. The German entrepreneur E3 operates with his German VAT identification number, even though he would be obliged to operate with an Austrian VAT identification number.

- Double acquisition:

You can find a classic VAT trap hidden within this example. Because even though the entitlement to deduct input tax is a fundamental principle of the common VAT system, an entrepreneur who does not follow the "chain transaction rules" and the registration obligations connected therewith is penalized by owing double acquisition tax (hence it is also called "double acquisition"), while only being allowed to claim input tax deduction once. (cf. 3.14. (13) example 1 UStAE).

- Acquisition 1 (in the country of arrival):

Pursuant to the "chain transaction rules" (§ 3d sentence 1 UStG) the VAT (acquisition tax) from the intra-Community acquisition of the sales transaction between E2 and E3 is to be paid in the country of arrival (Austria), but there is also an entitlement to reclaim this tax due as input VAT. This action would constitute a zero-sum game which the German entrepreneur E3, however, evades by omitting a VAT registration in Austria.

- Acquisition 2 (in the VAT ID country):

Pursuant to § 3d sentence 2 UStG, the acquisition shall be deemed to be effected in the VAT ID state as well (e.g. in Germany when using a German VAT identification number) and the entrepreneur is not entitled to deduct the VAT owed on the intra-Community acquisition as input tax (15.10. (2) sentence 2 UStAE). This means in the above example that the German entrepreneur E3 is obliged to pay the acquisition tax from the sales transaction between E2 and E3 to the German Tax Office due to the use of his German VAT identification number but gets no opportunity for an input tax deduction. This "affair" thus costs 19% of the value of the goods, which nobody replaces!

Only the proof of the taxation in the country of arrival (Austria) eliminates this additional acquisition.

In addition to the above notes, see excerpts of the relevant legal provisions relating to triangular transactions under the following links:

Note to the links to laws, guidelines and regulations: With the exception of the Directive of the VAT system, these are in German (also in the full version).

Please note the Terms of Use and the Disclaimer of Liability.

|

| |

| |

|

Ing. Gert Bluehberger

Arbeiterstrandbadstrasse 21

1210 Vienna

Austria |

Phone.:

Fax:

Email:

|

+43 660 / 666 00 26

+43 1 263 00 51

office 1 @ bilanzbuchhaltung-wien.at

(without space)

|

|