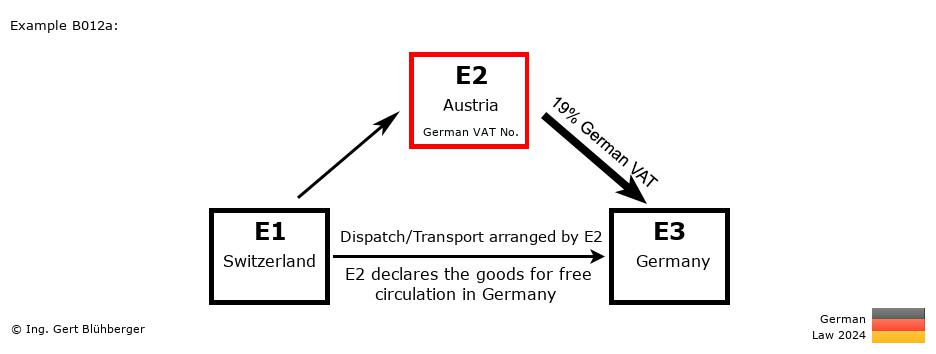

Facts:

A German entrepreneur E3 (= last purchaser) orders a machine at his Austrian supplier E2 (=1st purchaser). Since the supplier E2 does not have the machine in stock, he orders it from the Swiss wholesaler E1 (= first supplier).

The Austrian entrepreneur E2 instructs his forwarder with the pickup of the machine from the wholesaler E1 in Switzerland and subsequent delivery to the entrepreneur E3 to Germany. The forwarder declares the goods for free circulation in Germany under customs and tax law on behalf of the entrepreneur E2. Brief description of the chain transaction:

- Registration obligations:

- The Austrian entrepreneur E2 has to obtain a VAT registration in the country in which the goods are declared for free circulation (Germany) and from a German perspective additionally in the country of departure (Switzerland).

- "Supply 1" from E1 (Switzerland) to E2 (Austria)

- Transaction without transport/dispatch assignment (§ 3 (7) UStG)

- From a German perspective this is a taxable supply in Switzerland (E1).

- "Supply 2" from E2 (Austria) to E3 (Germany)

- Import value added tax:

- Since the Austrian entrepreneur E2 has the right to dispose of the goods when crossing the border, he is entitled to reclaim the import VAT as input VAT.

- Should E3 undertake the declaration for free circulation, the dispatch/transport would be assigned to the supply between E1 and E2, no relocation of the place of supply pursuant to § 3 (8) UStG takes place and § 4 No. 4b UStG applies. Once all conditions are met, the supply from E2 to E3 is tax-exempt. The declarant E3 is furthermore entitled to reclaim the import VAT as input VAT (see also 3.14. (16) example 1 UStAE). This applies in any case if the goods were previously in a bonded warehouse. If, on the other hand, the goods were declared for free circulation already when they crossed the border, please pay attention to example 8 at www.chain-transaction.de.

- Special features of this chain transaction

- Since the Austrian entrepreneur E2 undertakes the declaration for free circulation, he acts in accordance with § 3 (6a) sentence 7 UStG as supplier. As a result, the assignment of dispatch or transport shifts to the supply between E2 and E3.

- Because the Austrian entrepreneur E2 acts as supplier, a relocation of the place of supply according to § 3 (8) UStG to Germany takes place. As a result, the supply between E2 and E3 is taxable in Germany (19% German VAT) and the Austrian entrepreneur E2 has to register in Germany.

Detailed description from the perspective of the individual entrepreneurs: From the perspective of the 1st supplier E1 (from Switzerland): From the perspective of the 1st supplier E1 (from Switzerland):

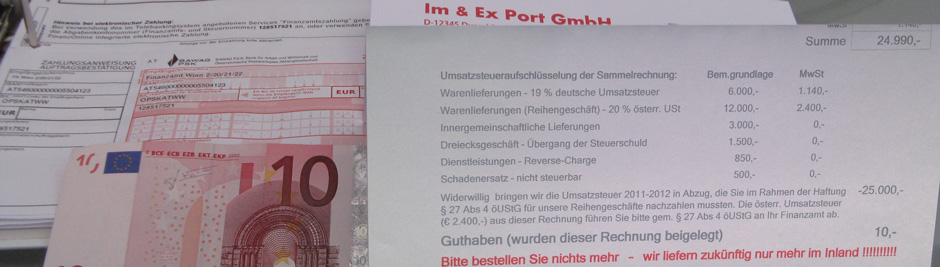

Outgoing Invoice:

- Invoicing:

From a German perspective this supply is taxable in Switzerland (E1). The invoice must probably be issued with Swiss VAT. Whether or not this sales transaction is subject to VAT is governed by the legal provisions of the third country and is not analyzed in more detail here, since Switzerland is only an example of many possible third countries.

- VAT Return:

A declaration in the VAT Return is governed by the legal provisions of the third country.

From the perspective of the 1st purchaser E2 (from Austria): From the perspective of the 1st purchaser E2 (from Austria):

Registration obligations:- From a German perspective the Austrian entrepreneur E2 has to obtain a VAT registration in the country of departure (Switzerland).

- Due to the relocation of the place of supply according to § 3 (8) UStG, the Austrian entrepreneur E2 must also obtain a VAT registration in the country in which the goods are declared for free circulation (Germany) and act with his German VAT identification number towards E3.

Incoming Invoice:

- VAT return (at the Swiss Tax Office):

Whether a Swiss VAT contained in the incoming invoice can be deducted as input tax is governed by the legal provisions of the third country and must be included in the VAT return accordingly.

Outgoing Invoice:

- Invoicing:

This supply is taxable in Germany due to the relocation of the place of supply to Germany pursuant to § 3 (8) UStG. The invoice must therefore be issued with 19 % German VAT and stating the own German VAT identification number.

- VAT returns:

a) at the Swiss Tax Office: A declaration in the VAT Return is governed by the statutory provisions of the third country.

b) at the German Tax Office: Declaration of the sales transaction as a taxable (domestic) supply in line 13/code 81 and payment of the VAT from this supply to the German Tax Office. In order to reclaim the import VAT as input VAT, the import VAT is to be included in the VAT Return in line 40/code 62 (Resulting Import VAT).

From the perspective of the last purchaser E3 (from Germany): From the perspective of the last purchaser E3 (from Germany):

Incoming Invoice:

- VAT return:

The German VAT contained in the incoming invoice can be deducted as input tax and must be included in the VAT return in line 38/code 66.

Notes to the chain transaction:

- The above detailed descriptions from the perspective of the entrepreneurs E1 and E2 only represent an indication of how the tax assessment would be if the German laws were to apply in Switzerland. National deviations from the German legislation were also not taken into account in the chain transaction sketch and the brief description!

- You can find the German version in the reihengeschaeftrechner.de.

- The assessment of this chain transaction from the Austrian perspective you can find in the reihengeschaeftrechner.at.

Please note the Terms of Use and the Disclaimer of Liability. |