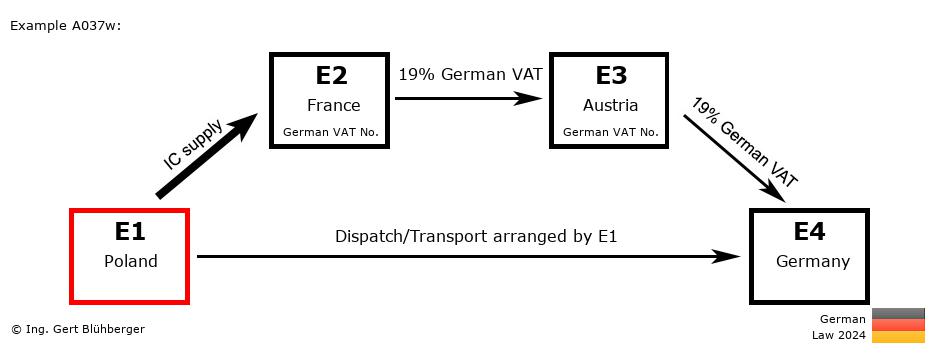

Facts:

A German entrepreneur E4 (= last purchaser) orders a machine from his Austrian supplier E3 (=2nd purchaser). The latter in turn orders the machine from the French wholesaler E2 (=1st purchaser). Since the wholesaler E2 does not have the machine in stock, he orders it from the Polish manufacturer E1 (=first supplier) and instructs him to dispatch the machine directly to the German entrepreneur E4. Brief description of the chain transaction:

- Registration obligations:

- The French entrepreneur E2 has to obtain a VAT registration in the destination country Germany.

- The Austrian entrepreneur E3 as well has to obtain a VAT registration in the destination country Germany.

- "Supply 1" from E1 (Poland) to E2 (France)

- Assignment of transport or dispatch according to § 3 (6) UStG in conjunction with § 3 (6a) sentence 2 UStG

- VAT-exempt supply in Poland (E1)

- Tax exemption pursuant to § 4 (1)(b) UStG in conjunction with § 6a UStG (intra-Community supply)

- "Supply 2" from E2 (France) to E3 (Austria)

- Transaction without transport/dispatch assignment (§ 3 (7) UStG)

- Taxable supply in Germany (E4)

- "Supply 3" from E3 (Austria) to E4 (Germany)

- Transaction without transport/dispatch assignment (§ 3 (7) UStG)

- Taxable supply in Germany (E4)

Detailed description from the perspective of the individual entrepreneurs: From the perspective of the 1st supplier E1 (from Poland): From the perspective of the 1st supplier E1 (from Poland):

Outgoing Invoice:

- Invoicing:

Invoice without VAT with reference to the tax exemption (intra-Community supply) pursuant to § 4 (1)(b) UStG in conjunction with § 6a UStG (or alternatively with reference to Article 138 of the Directive 2006/112/EC) and specification of the own (Polish) VAT identification number as well as the German VAT identification number of the French entrepreneur E2.

- VAT Return:

Declaration of the sales transaction as an intra-Community supply.

- EC Sales List (ESL / Recapitulative statement):

Declaration as (intra-Community) supply to the German VAT identification number of the French entrepreneur E2.

- Intrastat Supplementary Declaration (Intrastat SD):

Declaration as dispatch to Germany. Since 2022, the country of origin and the German VAT identification number of the French entrepreneur E2 must also be reported.

From the perspective of the 1st purchaser E2 (from France): From the perspective of the 1st purchaser E2 (from France):

Registration obligations:- The French entrepreneur E2 has to obtain a VAT registration in the destination country Germany and act with his German VAT identification number towards E1 and E3. The entries listed below are consequently to be included in the German VAT return and Intrastat SD.

Incoming Invoice:

- VAT return (at the German Tax Office):

The incoming invoice contains no VAT and is to be included as an intra-Community acquisition in the VAT return. This means, on the one hand, that the VAT (acquisition tax) (line 25/code 89) must be paid and, on the other hand, it can be treated as input tax (line 39/code 61) on the same return.

- Intrastat Supplementary Declaration (at the German authority):

Declaration as arrival from Poland.

Outgoing Invoice:

- Invoicing:

This supply is taxable in Germany (E4). The invoice must therefore be issued with 19 % German VAT and specification of the own German VAT identification number.

- VAT Return (at the German Tax Office):

Declaration of the sales transaction as a taxable (domestic) supply in line 13/code 81 and payment of the VAT from this supply to the German Tax Office.

From the perspective of the 2nd purchaser E3 (from Austria): From the perspective of the 2nd purchaser E3 (from Austria):

Registration obligations:- The Austrian entrepreneur E3 has to obtain a VAT registration in the destination country Germany and act with his German VAT identification number towards E2 and E4. The entries listed below must therefore be included in the German VAT return.

Incoming Invoice:

- VAT return (at the German Tax Office):

The German VAT contained in the incoming invoice can be deducted as input tax and must be included in the VAT return in line 38/code 66.

Outgoing Invoice:

- Invoicing:

This supply is taxable in Germany (E4). The invoice must therefore be issued with 19 % German VAT and specification of the own German VAT identification number.

- VAT Return (at the German Tax Office):

Declaration of the sales transaction as a taxable (domestic) supply in line 13/code 81 and payment of the VAT from this supply to the German Tax Office.

From the perspective of the last purchaser E4 (from Germany): From the perspective of the last purchaser E4 (from Germany):

Incoming Invoice:

- VAT return:

The German VAT contained in the incoming invoice can be deducted as input tax and is to be included in the VAT return in line 38/code 66.

Notes to the chain transaction:

- If the Austrian entrepreneur E3 arranges the dispatch (as purchaser) or the French entrepreneur E2 arranges the dispatch and acts as supplier by using a Polish VAT identification number, the tax exempt supply would be assigned to the supply between E2 and E3. This would make the simplification rules of triangular transactions for the entrepreneurs E2, E3 and E4 applicable.

- CAUTION: If the French entrepreneur E2 does not operate with a German VAT identification number but with his own French VAT identification number, for example, an additional intra-Community acquisition is triggered in the country of the used VAT identification number without entitlement to deduct VAT (§ 3d Sentence 2 UStG). This means that the entrepreneur E2 must pay VAT (acquisition tax) in France without entitlement to reclaim this VAT as input VAT. See also 3.14. (13) example 1 UStAE.

- The above detailed description from the perspective of the entrepreneur E1 only represents an indication of how the tax assessment would be if the German laws were to apply in Poland. National deviations from the German legislation were also not taken into account in the chain transaction sketch and the brief description!

- You can find the German version in the reihengeschaeftrechner.de.

- The assessment of this chain transaction from the Austrian perspective you can find in the reihengeschaeftrechner.at.

Please note the Terms of Use and the Disclaimer of Liability. |