| ||||||||||||||||||||||||||||||||||||||||||||||

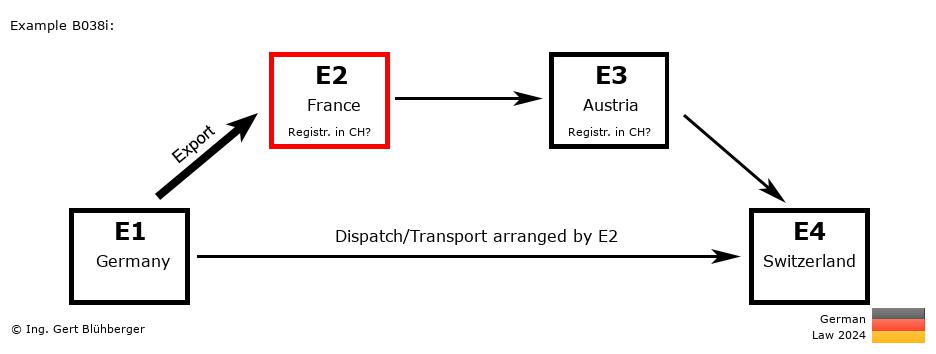

Chain Transaction Calculator Germany 2026:Select the countries participating in the chain transaction in the sequence of the invoicing path:

| ||||||||||||||||||||||||||||||||||||||||||||||

| Attention:

In the (free) version used, only one possible evaluation is shown. However, by application of the Quick Fixes, up to three solutions are actually possible! With a registration in the chain transaction calculator (from € 80,-/year) you will find up to two alternative variants additionally displayed, which can ideally save you a registration abroad. | ||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||

Paid access (from EUR 80,-/year):The free version contains only the chain transaction sketch above.The paid version contains a detailed description and in addition you will learn among other things:

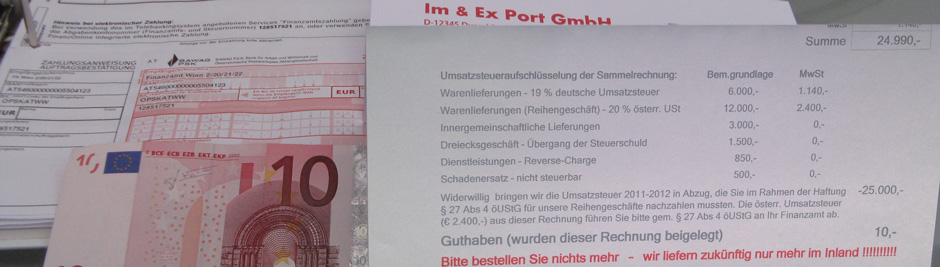

Sample examples:

On the order page you will find a short description of the above license models. Detailed information can be found in the price list and usage contract. Please note the Terms of Use and the Disclaimer of Liability. |

| Cookie-Policy Privacy-Policy |