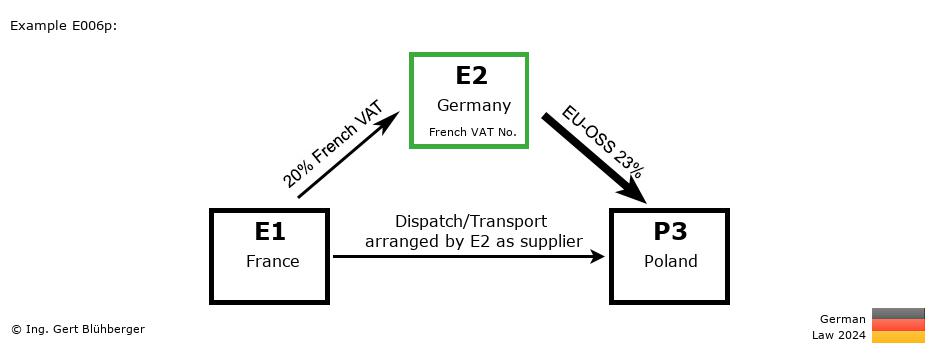

Facts:

A privat individual P3 from Poland (= last purchaser) orders a machine at his German supplier E2 (=1st purchaser). Since the supplier E2 does not have the machine in stock, he orders it from the French wholesaler E1 (= first supplier).

The German entrepreneur E2 instructs his forwarder with the pickup of the machine from the French wholesaler E1 and subsequent delivery to the individual P3 to Poland. The German entrepreneur E2 (=intermediary operator) acts with his French VAT identification number and he communicates it to the French wholesaler E1 in writing in the order document at the latest until the beginning of the shipment. Brief description of the chain transaction:

- Registration obligations:

- The German entrepreneur E2 has to obtain a VAT registration in the country of departure (France).

- "Supply 1" from E1 (France) to E2 (Germany)

- Transaction without transport/dispatch assignment (§ 3 (7) UStG)

- Taxable supply in France (E1)

- "Supply 2" from E2 (Germany) to P3 (Poland)

- Special features of this chain transaction

- Since the German entrepreneur E2 acts with his French VAT identification number towards the French entrepreneur E1, the provision of the § 3 (6a) UStG (Article 36a (2) of the Directive 2006/112/EC) applies. As a result, E2 acts as supplier and the assignment of dispatch or transport shifts to the supply between E2 and P3.

- Since the German entrepreneur E2 acts as supplier and P3 is a private individual, this is an intra-Community distance sale according to § 3c (1) UStG. Therefore, for the supply from E2 to P3 (since 1.7.2021) the place of supply shifts to Poland pursuant to § 3c (1) UStG. The entrepreneur E2 can, however, participate in the special scheme (special taxation procedure) according to § 18j UStG (EU-OSS) if all requirements are fulfilled and thus saves a registration in the destination country Poland, if applicable.

Detailed description from the perspective of the individual entrepreneurs: From the perspective of the 1st supplier E1 (from France): From the perspective of the 1st supplier E1 (from France):

Outgoing Invoice:

- Invoicing:

This supply is taxable in France (E1). The invoice must therefore be issued with 20 % French VAT, stating the own (French) VAT identification number.

- VAT Return:

Declaration of the sales transaction as a taxable (domestic) supply.

From the perspective of the 1st purchaser E2 (from Germany): From the perspective of the 1st purchaser E2 (from Germany):

Registration obligations:- The German entrepreneur E2 has to obtain a VAT registration in the country of departure (France) and act with his French VAT identification number towards E1. The entries listed below are consequently to be included in the French VAT return and Intrastat SD.

Incoming Invoice:

- VAT return (at the French Tax Office):

The French VAT contained in the incoming invoice can be deducted as input tax and must be included in the VAT return accordingly.

Outgoing Invoice:

- Invoicing:

This supply is taxable in Poland due to the relocation of the place of supply according to § 3c (1) UStG. When issuing an invoice, this must therefore be issued with 23 % Polish VAT.

- VAT Return (at the French Tax Office):

By participating in the special scheme (special taxation procedure) according to § 18j UStG, no taxable supply has to be reported in the French VAT return, but the sales transaction has to be reported in the German VAT return in line 36/code 45 (sales not taxable in Germany). In addition, this sales transaction must be reported in the EU-OSS portal and the VAT must be paid accordingly.

- Intrastat Supplementary Declaration (at the French authority):

Declaration as dispatch to Poland. Since 2022, the country of origin must also be indicated and the following reporting obligations have applied since then: Instead of a VAT registration number, the fictitious number QN999999999999 must be entered for a private individual (P3) and for "nature of transaction", code 12 (instead of the previous code 11) has to be entered.

Note: If the German entrepreneur E2 exceeds the VAT-threshold (as well as the INTRASTAT assimilation threshold of the destination member state) in the country of destination (Poland), then he is basically also obliged to provide information for the imported goods in Poland!

From the perspective of the last purchaser P3 (from Poland): From the perspective of the last purchaser P3 (from Poland):

- As a private individual, the last purchaser is not subject to any reporting obligations.

Notes to the chain transaction:

- The above detailed descriptions from the perspective of the individual entrepreneurs represent only an indication of how the tax assessment would be if the German laws were to apply in France and in Poland. National deviations from the German legislation were also not taken into account in the chain transaction sketch and the brief description!

- With the BMF letter dated 25.04.2023, the Value Added Tax Application Decree (UStAE) regarding the VAT treatment of chain transactions was completely revised (incorporation of the Quick Fixes). From this date onwards, it is essential for the German entrepreneur E2 (who in this example acts as a supplier by using a French VAT identification number) to be able to prove, as stated in the 3.14. (10) UStAE, that he has already transmitted the VAT identification number to the French entrepreneur E1 before shipment (ideally in writing in the order document).

- You can find the German version in the reihengeschaeftrechner.de.

Please note the Terms of Use and the Disclaimer of Liability. |