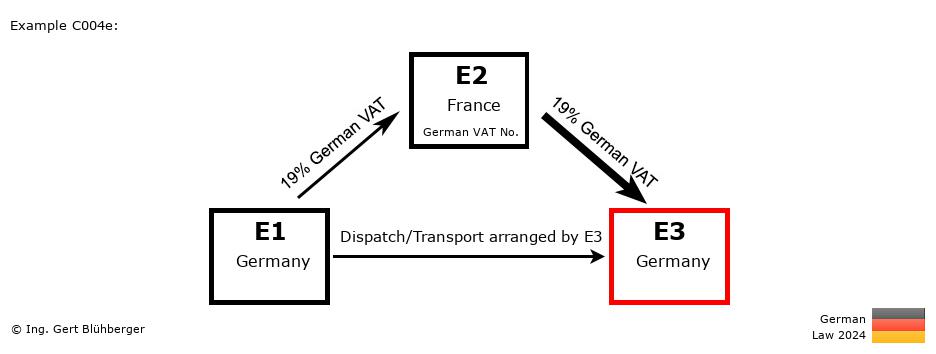

Facts:

A German entrepreneur E3 (= last purchaser) orders a machine at his French supplier E2 (=1st purchaser). Since the supplier E2 does not have the machine in stock, he orders it from the German wholesaler E1 (= first supplier).

The German entrepreneur E3 picks up of the machine from the German wholesaler E1. Brief description of the chain transaction:

- Registration obligations:

- The French entrepreneur E2 has to obtain a VAT registration in the country of departure (Germany).

- "Supply 1" from E1 (Germany) to E2 (France)

- Transaction without transport/dispatch assignment (§ 3 (7) UStG)

- Taxable supply in Germany (E1)

- "Supply 2" from E2 (France) to E3 (Germany)

- Assignment of transport or dispatch according to § 3 (6) UStG in conjunction with § 3 (6a) sentence 3 UStG

- Taxable supply in Germany (E1)

- Special feature of this chain transaction

- Since the goods do not leave the country, there is no tax-exempt supply in this chain transaction. All supplies are taxable in Germany.

Detailed description from the perspective of the individual entrepreneurs: From the perspective of the 1st supplier E1 (from Germany): From the perspective of the 1st supplier E1 (from Germany):

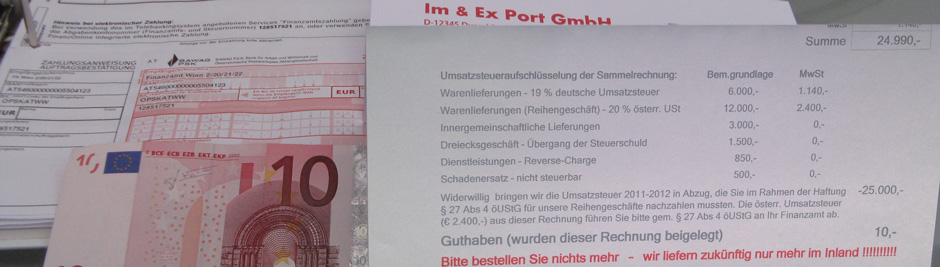

Outgoing Invoice:

- Invoicing:

This supply is taxable in Germany (E1). The invoice must therefore be issued with 19 % German VAT, stating the own (German) VAT identification number.

- VAT Return:

Declaration of the sales transaction in line 13/code 81 as taxable (domestic) supply.

From the perspective of the 1st purchaser E2 (from France): From the perspective of the 1st purchaser E2 (from France):

Registration obligations:- The French entrepreneur E2 has to obtain a VAT registration in the country of departure (Germany) and act with his German VAT identification number towards E1 and E3. The entries listed below are consequently to be included in the German VAT return.

Incoming Invoice:

- VAT return (at the German Tax Office):

The German VAT contained in the incoming invoice can be deducted as input tax and must be included in the VAT return in line 38/code 66.

Outgoing Invoice:

- Invoicing:

This supply is taxable in Germany (E1). The invoice must therefore be issued with 19 % German VAT, stating the own German VAT identification number.

- VAT Return (at the German Tax Office):

Declaration of the sales transaction as a taxable (domestic) supply in line 13/code 81 and payment of the VAT from this supply to the German Tax Office.

From the perspective of the last purchaser E3 (from Germany): From the perspective of the last purchaser E3 (from Germany):

Incoming Invoice:

- VAT return:

The German VAT contained in the incoming invoice can be deducted as input tax and must be included in the VAT return in line 38/code 66.

Notes to the chain transaction:

Please note the Terms of Use and the Disclaimer of Liability. |