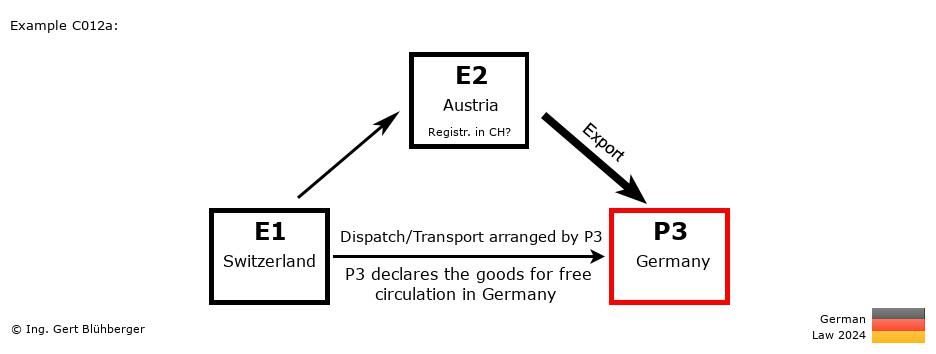

Facts:

A privat individual P3 from Germany (= last purchaser) orders a machine at his Austrian supplier E2 (=1st purchaser). Since the supplier E2 does not have the machine in stock, he orders it from the Swiss wholesaler E1 (= first supplier).

The German individual P3 picks up the machine from the wholesaler E1 in Switzerland and declares the goods for free circulation in Germany. Brief description of the chain transaction:

- Registration obligations:

- From a German perspective the Austrian entrepreneur E2 has to obtain a VAT registration in the country of departure (Switzerland).

- "Supply 1" from E1 (Switzerland) to E2 (Austria)

- Transaction without transport/dispatch assignment (§ 3 (7) UStG)

- From a German perspective this is a taxable supply in Switzerland (E1).

- "Supply 2" from E2 (Austria) to P3 (Germany)

- Assignment of transport or dispatch according to § 3 (6) UStG in conjunction with § 3 (6a) sentence 3 UStG

- VAT-exempt supply in Switzerland (E1)

- Tax exemption (from a German perspective) pursuant to § 4 (1)(a) UStG in conjunction with § 6 UStG (export supply)

- Import value added tax:

- The last purchaser P3 from Germany has the power of disposal for VAT purposes when crossing the border and has to pay the import VAT. As a private person, P3 is not entitled to reclaim the import VAT as input VAT.

- Special features of this chain transaction

- Although the last customer P3 is a private idividual, there is no distance sale in this example even with a value of goods up to EUR 150, because the goods are picked up by P3 and a distance selling according to the definition in § 3 (3a) UStG would only exist if E2 would carry out the transport (or would be indirectly involved in it). The special scheme (special taxation procedure) pursuant to § 18k UStG (IOSS) is therefore not applicable.

- If, on the other hand, the Austrian entrepreneur E2 intervenes indirectly in the transport or dispatch of the goods, then a distance sale pursuant to § 3c (3) in conjunction with § 3 (3a) UStG exists. Already the advertising of a delivery service or the transmission of information to a delivery agent, which the latter requires for the delivery of the items to the purchaser, shall be considered as indirect involvement of the supplier. If the value of the goods does not exceed EUR 150, the entrepreneur E2 can use the special scheme (special taxation procedure) according to § 18k UStG (IOSS) if all requirements are met and in this case (since 1.7.2021) there is a relocation of the place of supply according to § 3c (3) UStG to Germany. The supply to P3 becomes taxable in Germany (19% German VAT) and E2 has to report this sales transaction in the IOSS portal and pay the VAT accordingly. The import, on the other hand, is tax-exempt according to § 5 (1) Nr. 7 UStG and E2 must therefore neither pay import VAT nor claim the input tax deduction from the title of the import VAT. Due to this constellation and also because the import within the IOSS system is only possible if the identification number of the supplier (U2) is indicated, the declaration for free circulation is made by E2 instead of P3, in contrast to the situation described above.

Detailed description from the perspective of the individual entrepreneurs: From the perspective of the 1st supplier E1 (from Switzerland): From the perspective of the 1st supplier E1 (from Switzerland):

Outgoing Invoice:

- Invoicing:

From a German perspective this supply is taxable in Switzerland (E1). The invoice must probably be issued with Swiss VAT. Whether or not this sales transaction is subject to VAT is governed by the legal provisions of the third country and is not analyzed in more detail here, since Switzerland is only an example of many possible third countries.

- VAT Return:

A declaration in the VAT Return is governed by the legal provisions of the third country.

From the perspective of the 1st purchaser E2 (from Austria): From the perspective of the 1st purchaser E2 (from Austria):

Registration obligations:- From a German perspective the Austrian entrepreneur E2 has to obtain a VAT registration in the country of departure (Switzerland). The entries listed below are consequently to be included in the Swiss VAT return.

Incoming Invoice:

- VAT return (at the Swiss Tax Office):

Whether or not a declaration is required in the VAT return is governed by the legal provisions of the third country and is not analyzed in more detail here, since Switzerland is only an example of many possible third countries.

Outgoing Invoice:

- Invoicing:

Invoice without VAT with reference to the tax exemption (tax-free export supply) according to § 4 (1)(a) UStG in conjunction with § 6 UStG (or alternatively with reference to Article 146 of the Directive 2006/112/EC). When participating in the special scheme (special taxation procedure) according to § 18k UStG (for shipments up to EUR 150 if E2 is indirectly involved in the transport), when issuing an invoice, it must be issued with 19 % German VAT.

- VAT Return (at the Swiss Tax Office):

Declaration of the sales transaction as a tax-exempt export supply.

In case of participation in the special scheme (special taxation procedure) according to § 18k UStG (for shipments up to EUR 150 in case of indirect participation of E2 in the transport), this sales transaction must be reported in the IOSS portal and the VAT must be paid accordingly.

From the perspective of the last purchaser P3 (from Germany): From the perspective of the last purchaser P3 (from Germany):

- As a private individual, the last purchaser is not subject to any reporting obligations.

Notes to the chain transaction:

- The above detailed descriptions from the perspective of the entrepreneurs E1 and E2 only represent an indication of how the tax assessment would be if the German laws were to apply in Switzerland. National deviations from the German legislation were also not taken into account in the chain transaction sketch and the brief description!

- If a postal service provider or courier service has been contracted to handle the consignment, this service provider can, if all requirements are met, apply the special regulation for the import of goods with a material value of EUR 150 or less according to § 21a UStG, as the declaration for free circulation is made for the last purchaser P3 and because no tax exemption according to § 5 (1) Nr. 7 UStG is claimed without applying § 18k UStG. This form of an electronic customs declaration contains a reduced data set compared to the standard customs declaration.

- You can find the German version in the reihengeschaeftrechner.de.

- The assessment of this chain transaction from the Austrian perspective you can find in the reihengeschaeftrechner.at.

Please note the Terms of Use and the Disclaimer of Liability. |